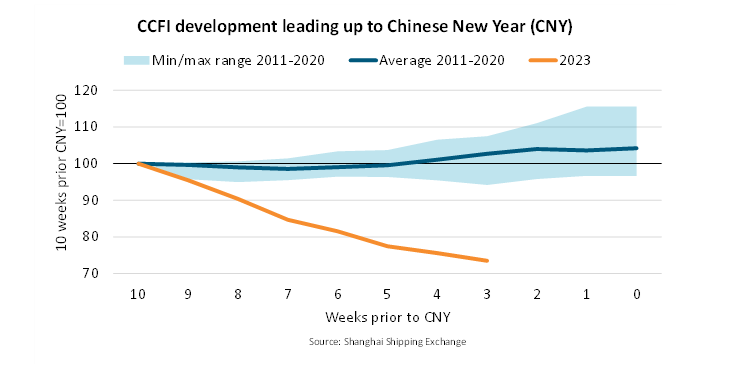

The weeks leading up to Chinese New Year typically bring increased demand for exports from China and spikes in ocean freight prices. Unlike previous years, 2022 has seen the opposite. Container demand to U.S. East/West coast ports according to the China Containerized Freight Index has dropped by 27% and 26%. Paired with the decreased demand in volume, freight rates from China have seen an unusual decrease in the weeks leading up to Chinese New Year. What is normally a 4% increase over 10 weeks leading up to Chinese New Year has turned into a 27% decrease in ocean freight rates since mid-November 2022. Furthermore, Chinese ocean export rates have fallen 50% from February 2022 to mid-November 2022.

A decline in Chinese exports does not necessarily mean a decline in import demand to the United States. Manufacturing uncertainties in China have caused many importers to shift their operations outside of China. As a result, a 4.7% decrease in Chinese exports from January to November brought a 13.3% increase in Vietnamese exports and a 14.9% increase in Indian exports. If the trend of moving operations outside of China continues, the East Coast may begin to see more activity than Los Angeles/Long Beach ports. South and Southeastern Asia freight typically moves to the East Coast via the Suez Canal and a significant portion of Los Angeles/Long Beach port activity is driven by Chinese freight. While it may be too soon to tell now, the long term effects of manufacturing operations changes could bring drastic changes to the major East and West Coast ports in the US in the future.

Airfreight industry watches for signs of midyear recovery

2022, year for the airline industry and what changes are expected for 2023.

United States, Mexico and Canada Joint Statement on the Second USMCA/CUSMA/T-MEC Deputies Meeting

The United States, Canada and Mexico held the second meeting of Deputies under the USMCA/CUSMA/T-MEC at the Institute of the Americas in San Diego, California. Continued implementation of the USMCA/CUSMA/T-MEC is an important priority for the USA, Canada and Mexico, and the Agreement remains the foundation for continued North American economic integration and enhanced regional competitiveness.

USTR Extends Exclusions from China Section 301 Tariffs

Do the China 301 tariff rates have you anxious? The Office of the United States Trade Representative announced a nine‑month extension of 352 product exclusions in the China Section 301 Investigation that had been scheduled to expire at the end of 2022.

CBP Highlights Top 2022 Accomplishments

U.S. Customs and Border Protection outlined its successful 2022 efforts to enhance trade, improve the traveler experience, and strengthen our nation’s borders through a wide array of initiatives and improvements that allow us to better serve the public and fulfill the CBP mission.

Indianapolis CBP Sees 55 Percent Increase in Counterfeit Goods in FY 2022

USCBP Indianapolis notes record number of fraudulent counterfeits during Fiscal Year 2022. CBP officers saw hundreds of packages that contained counterfeit items.

Canada joins the Americas Partnership for Economic Prosperity

Led by the United States, APEP is a new framework for cooperation across the Americas aiming to deliver economic growth in the region, generate good middle-class jobs and reduce economic inequality.

Canada, Mexico win auto rules trade dispute with U.S

Canada and Mexico have won their challenge to the U.S. interpretation of content rules for autos under the new North American trade pact, a dispute panel ruled on Wednesday, a decision that favors parts makers north and south of the U.S. border.

The CBSA marks International Customs Day 2023 and its upcoming 20th anniversary

January 26, the Canada Border Services Agency (CBSA) will join other customs agencies around the world in marking International Customs Day.

Mexico, Canada win auto trade dispute against U.S

Canada and Mexico have won their challenge to the U.S. interpretation of content rules under USMCA for automobiles on January 11th. A complaint was filed a year ago in regards to how to determine if a vehicle qualifies for tax-free status based on the originating percentage of its parts. Canada and Mexico say that is a “core part of the vehicle, such as the engine or transmission, has 75% regional content, USCMA allows that number to be rounded up to 100% when calculating broader requirement of the entire car.

Port of Long Beach misses record as cargo flow returns to “normal”

The current state of Long Beach port and what 2022 numbers turned out to be.

Additional regulations on composite wood products coming into force

Environment and Climate Change Canada (ECCC) recently informed those who manufacture, import, or sell composite wood products containing formaldehyde that regulations have come into force on January 7th, 2023. The sale or import of composite wood products that release formaldehyde at levels that exceed emission limits are now prohibited. Formaldehyde is a colourless gas that is emitted from certain household products and building materials, such as the following composite wood products: particleboard, fibreboard, hardwood plywood, laminated wood products.

Canada launches public consultations on trade negotiations with Ecuador

These consultations will help identify business opportunities and market access for Canadian goods and services in Ecuador, as well as improve transparency for Canadian businesses currently operating in that country. Canadians and interested stakeholders can join the discussion on possible Free Trade Agreement negotiations with Ecuador until February 21st, 2023. Submissions received will help define Canada’s priorities in trade negotiations.

U.S. and Japan launch a human rights task force

These two nations are working together to advance a common trade agenda, which includes promoting respect for internationally recognized labor rights. The use of forced labor in supply chains will be prohibited through trade policy, and the nations will exchange information on relevant laws and policies.

How will Maersk-MSC split redraw container shipping landscape?

The expected impact of Maersk and MSC terminating their alliance and operating independently.

Get in touch with us!

4444 Wyoming Ave. Detroit, Michigan 48216 | Phone: 313-965-8299 | Fax: 313-965-7399

For more information on Cavalry Logistics International, please visit www.shipwithU.com/international.

For more information on Universal Logistics Holdings, Inc., visit www.universallogistics.com.